Swapitor’s primary aim is to democratize access to investment education by facilitating a seamless connection between aspiring learners and investment education firms. We have made the process easier for interested individuals who want to learn more about investments and the financial markets.

With Swapitor’s pathway, users can easily access investment education firms without making payments. We have collaborated with many investment education firms to serve the needs of a broad user base who want to improve their understanding of the investment world.

Swapitoroffers a user-friendly solution where individuals can quickly connect with investment education firms without experiencing hassles. Our goal in the finance landscape is to be a channel that users can rely on to acquire investment education.

While Swapitor does not offer investment educational services, we are committed to making our gateway more accessible for interested persons who want to deepen their investment knowledge. We provide free services, ensuring that aspiring learners can become financially literate.

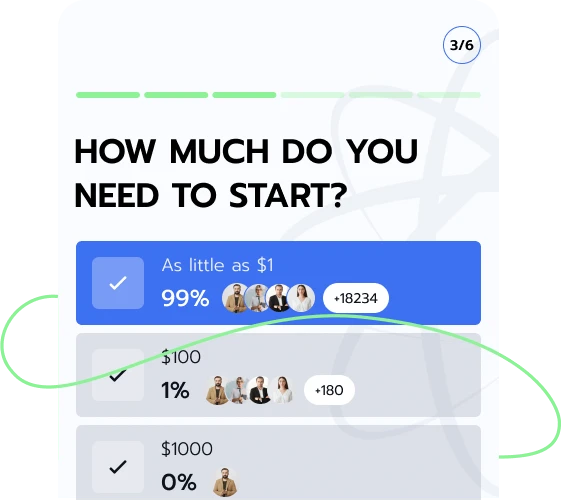

Anyone who encounters Swapitor will notice the ease of registration. We implemented a seamless registration process to sustain the interest of every prospective learner.

Also, our solution is not only for those with investment experience; our services are positioned to meet the needs of all interested learners worldwide.

While investment education might come at a cost depending on the medium used, Swapitor wants to help individuals access learning providers for free.

This is why Swapitor has introduced initiatives to make sure every eager learner can connect with investment education providers at no cost.

This strategy refers to investing a fixed amount regularly, irrespective of market conditions. Dollar-cost averaging may help to manage the effect of market volatility.

Buy-and-hold strategy involves buying securities and holding them for a long time, mainly through market fluctuations.

Value investing entails looking out for stocks perceived to be undervalued by the market.

While Swapitor recognizes that not all individuals will actively participate in the investment markets, understanding the practice is essential, especially in modern society. Swapitor has opened its pathway to everyone who wants to understand basic investing concepts and those who desire to learn how the financial markets work.

Swapitor is for categories of individuals like newbie investors, experienced investors, retirees, business owners, adults, parents, senior citizens, etc. With our gateway, individuals can acquire knowledge and skills to make informed choices in different areas of their lives.

Swapitor offers a seamless registration process, which sustains every learner's motivation to acquire knowledge about the financial markets. Individuals will only spend a short time signing up on Swapitor before they are connected to investment education firms.

When individuals register on Swapitor, an investment education firm representative will call them to provide insights and tips as they begin their educational journey. This contact ensures that the users know what to expect when they commence their investment learning.

During the registration process with Swapitor, we require prospective users to submit accurate information. It enables them to be paired with an investment education firm to kickstart their learning journey. Interested individuals must submit their names, emails, and phone numbers to get started. Here are some categories of individuals who may need investment education:

Retirees

Individuals who are about to retire or in retirement will need investment education to make informed decisions about life during retirement.

Business Owners

Business owners and entrepreneurs may require the insights into the economy that investment education provides to pursue their business objectives.

Students

Students can learn more about the fundamentals of investing to lay a solid foundation for financial literacy.

While the investment world may look appealing and promising, it is essential to mention that investing has no guarantees. Hence, individuals should prioritize investment education to adopt an objective approach as they interact with the financial markets.

One of the ways for users to make informed decisions is to acquire investment education to understand how the financial markets work. With investment education, individuals can create measurable objectives. Those who want to learn how to make enlightened choices can sign up with Swapitor and get connected to investment education firms to begin.

Investment education firms provide individuals with knowledge and training to interact with the finance world. These firms offer educational services through different channels and systems to deepen the understanding of their students.

Investment education firms cater to individuals of varying experience levels, equipping them with understanding to improve their financial literacy. They teach risk management, asset allocation, market and technical analysis, etc. By utilizing technological advancement, investment education firms reach more interested learners from different parts of the world as they can learn about investing on their devices.

These investment educators use various educational tools like interactive sessions, online courses, and other informational materials to help learners understand more about investing. By signing up on Swapitor, interested persons can commence an investment education at these firms.

Investment education firms teach investing based on a region and from a global standpoint. It is interesting to note that investment educators allow students to learn at their pace, emphasizing flexibility and convenience.

Investment education firms offer a broad range of educational services, equipping individuals to solidify their understanding of diverse concepts in the investing world. This insight will enable them to navigate the financial markets with an informed mindset. Here are some of the investment aspects that investment education firms cover.

When individuals register for investment education through Swapitor, they learn about risk management, its role in investing, and possible protection from challenging market conditions. An education on risk management helps individuals learn more about concepts like credit risk, volatility, liquidity risk, etc.

Market analysis in investing involves the assessment of the financial markets and economic indicators to make informed and data-driven decisions. When users register for investment education with Swapitor, they learn how to conduct fundamental and technical analyses to evaluate possible risks and returns in the investment space.

Regulatory compliance involves following regulations and laws to ensure fair market practices. With investment education firms, individuals may learn about the trading and ethical standards associated with the financial markets.

Investment education firms provide individuals with educational materials and training to shed light on behavioral finance. The impact of emotions and bias on investment decisions must be considered. With Swapitor’s channel, users can connect with investment education firms to learn more.

As pre-retirees transition to the point of retirement, learning about investments may hold significant relevance for them. With investment education, pre-retirees can get insights on risk and returns and align investment options with their retirement objectives.

Pre-retirees can enroll in investment education to help them explore options and strategies they may employ in retirement. When pre-retirees register on Swapitor, they connect with investment education firms to learn more about investment in retirement.

Swapitor is a worldwide solution that connects intending learners with investment education providers. With this connection, individuals will be able to deepen their understanding of investing concepts and principles.

With our unique pathways, Swapitor is focused on helping users make informed financial decisions as they interact with the markets.

By offering free access to investment education firms, Swapitor ensures that no individual is restricted from investment learning because of their financial status.

When individuals register on Swapitor for free, they are connected to investment education firms to begin their learning journey. Swapitor fosters seamless access to investment educators, ensuring users are enlightened on participating in the financial markets. When signing up on Swapitor, individuals are advised to use their correct information to enable them to get assigned to investment educators.

This is defined as the total market value of an organization’s outstanding shares. With market capitalization, the size of an organization and its position in the market can be gauged.

The ROI is a measure of an investment’s earnings. A negative ROI shows a loss, while a positive ROI indicates investment gains.

Volatility is often used to understand the risk level of an investment. After individuals register with Swapitor, they can learn about volatility when they connect with investment educators.

Dividend yield is the possible annual dividend income, which is a percentage of the investment’s current market price.

This investment metric evaluates an organization’s capacity to fulfill its short-term obligations with its liquid assets.

Current ratio is a company’s ability to meet its short-term liabilities with its short-term assets.

To avoid making uninformed decisions in the financial markets, individuals are advised to acquire sufficient knowledge. This acquisition can be achieved by enrolling for investment education by registering with Swapitor.

While Swapitor does not teach about investments, we provide individuals with access to investment education firms that empower users with knowledge and skills to navigate the markets.